Top 3 Revenue KPIs Every Practice Needs to Stay on Top of

Featured eBook

Common signs of a healthy and thriving practice are typically a packed parking lot, full waiting rooms, and staff moving quickly through patient queues. But do those signs indicate success?

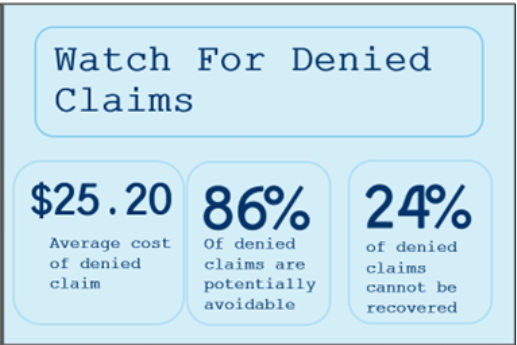

How busy a practice is does not always equate to financial health and practice efficiency. There are other, more telling indicators of the health of the practice. These indicators track movement in the business behind the scenes and are not evident to the naked eye. For instance, one indicator of success is the percentage of claims denied. The lower the percentage, the better. A denied claim costs an average of $25.20 to rework, according to the MGMA. The cost of many denied claims quickly starts to look like a considerable revenue loss. In fact, 86% of denials are potentially avoidable, and 24% of denied claims cannot be recovered. All those indications belie the surface perspective of lots of patients and activity.

In this blog, we’ll identify the key indicators of success, offer an interpretation of those key indicators, and highlight the benefits of keeping track of critical indicators.

Track the Right Key Performance Indicators

Key Performance Indicators, or KPIs, are metrics that help determine the effectiveness and efficiency in many practice areas. Often, these indicators are “at-a-glance” numbers that provide a quick but meaningful snapshot of how things are going. A good KPI relates directly to the goals of your practice. KPIs are specific and measurable, which means they help make critical practice decisions for more effective practice.

KPIs are particularly useful in understanding your healthcare revenue cycle. Revenue-related KPIs are often considered “core” indicators because they help you closely track your practice’s financial health. These KPIs offer glimpses into where efficiencies and inefficiencies in your revenue cycle might lie.

If you are not closely tracking your core KPIs, you may be putting potential revenue at risk. There may be a few reasons for not keeping a sharp eye on KPIs. For instance, it may be challenging to know which KPI is meaningful. It may be that your practice management software does not make it easy to locate useful KPIs. Or perhaps you outsource medical billing, and that service does not provide the meaningful metric you need.

The important thing is to find and track the right KPIs for your practice’s revenue cycle and then consistently pay attention to them. The right KPIs are like health markers for the financial growth of your practice.

3 Crucial KPIs to Watch

Watching your practice KPIs is like keeping patients healthy: it is the point of your practice, and your staff knows precisely the indicators of health at every patient visit. Regularly checking your KPIs can give you a measure of satisfaction that the practice is moving forward in a healthy manner. You may choose to track how claims move through your revenue cycle and the revenue generated by those claims. Or how long it takes for payment to arrive, which affects cash flow.

Three KPIs are particularly useful for assessing practice effectiveness: denial rate, clean claims rate, and days in accounts receivable.

Denial Rate

Denial rate is the percentage of claims denied by payers over time, and it is a critical indicator of practice efficiency. The higher the percentage of denials, the more work and cost are involved in resubmitting and eventually getting claims paid. This KPI shows how effective a practice’s revenue cycles are:

- A low denial rate indicates a healthy cash flow

- A high denial rate indicates a leakage in revenue

Calculate the denial rate by dividing the total dollar amount of the denied claims by the total dollar amount of claims submitted.

Estimates vary on how many claims are denied. Nearly 17 percent of in-network claims were denied in 2021 with insurer denial rates ranging from 2 percent to 49%. A more typical industry average denial rate is typically five to ten percent. It is clear that the lower the denial rate, the better.

When you aim at a denial rate of less than 5 percent, over 95 percent of the claims your team submits are accepted—which is excellent. While a denial rate of five to ten percent is acceptable, a denial rate of over ten percent indicates a need to take a close look at the revenue cycle management process.

Reworking submissions from a high denial rate is an indicator that your staff is not effectively deployed. Perhaps attention to denied claims pulls overworked staff from more pressing, patient-focused tasks. Fixing a high denial rate involves staff training and close attention to the common reasons for denials:

- Lack of prior authorization

- Out-of-network provider

- Exclusion of a service

By focusing on these common reasons for denials, staff can catch potential denials before they happen, which frees their time for other tasks.

Clean Claims Rate

A clean claims is error-free and includes the necessary clarifying detail in the form of supporting documentation. A clean claim makes it as easy as possible to be processed.

The clean claims rate is defined as the percentage of submitted claims that are accepted on their first submission to the payer. Naturally, having claims resolved in the first go-round is the goal of every practice. That’s because every time your staff touches a claim to rework the submission, it costs the practice money and causes delays in receiving revenue. Additional staff training may help improve coding. Given how short-staffed many practices are, continually dealing with denied claims is inefficient and keeps staff from more critical tasks.

The industry average for clean claims is 95%. An average of 98% or better would be a good goal for a clean claims rate.

Days in Accounts Receivable

Timely payment is essential for a healthy practice. Salaries, equipment leases, rent all depend on revenue arriving within the terms you have set. Bridge loans may help meet these financial obligations, but they typically carry high interest rates. Focusing on how long it takes to receive payment is a first step toward resolving this problem.

This KPI is the average number of days to collect payment for services provided and gives you a sense of how quickly payment is arriving. The lower the number, the faster your practice is getting paid.

The industry average for Days in A/R is 35 days. Actual Days in A/R will vary by practice and will, of course, be influenced by factors like the payer mix and the percentage of out-of-network claims. To get an even closer handle on this KPI, it may be helpful to differentiate Days in A/R for in-network versus out-of-network claims.

An Easy Way to Watch Revenue Cycle KPIs

Keeping an eye on critical KPIs to ensure your practice is working as designed is simpler when using a service like Veradigm’s Practice Management software. This software is built for health organizations and helps efficiently track key KPIs, along with providing excellent billing and claims processing, easy scheduling, and all the necessary front-office and back-office operations.

Veradigm Practice Management excels in helping you keep track of three key KPIs mentioned here:

- Denial Rate and Clean Claim Rate: The software has an impressive first-pass clean claim rate of 98%, which means that staff is not wasting time reworking denied claims and can focus on other work at hand.

- Days in A/R Rate: Given far fewer denied claims, the resulting clean claim rate climbs to lower the average days in accounts receivable.

Track KPIs to Keep Your Practice Healthy for Patients

Your practice is in the business of providing quality patient care. To continue doing that, it must function efficiently and remain profitable. Consistently tracking certain important KPIs is a route toward efficiency and profitability.

Download the Veradigm eBook “Identifying the Right Metrics and KPIs for Your Practice” for the full story. Then, let’s talk about how we can help improve your KPIs.